Following Aetna’s recent announcement, additional health plans have followed suit and instructed all brokerages to mark a subset of their 2025 Medicare Advantage plans as non-commissionable.

Key Details:

- No commissions will be paid for these plans starting on 11/4; see the number of plans marked non-commissionable by health plan:

| Health Plan | Plan Count Suppression | States Impacted |

| Anthem / Elevance | 66 | CT, NH, NJ, VA, GA, IN, KY |

| Cigna | 34 | TX, CO, UT, AL, AZ, NY, AR, GA, NJ, MS, OR, OK |

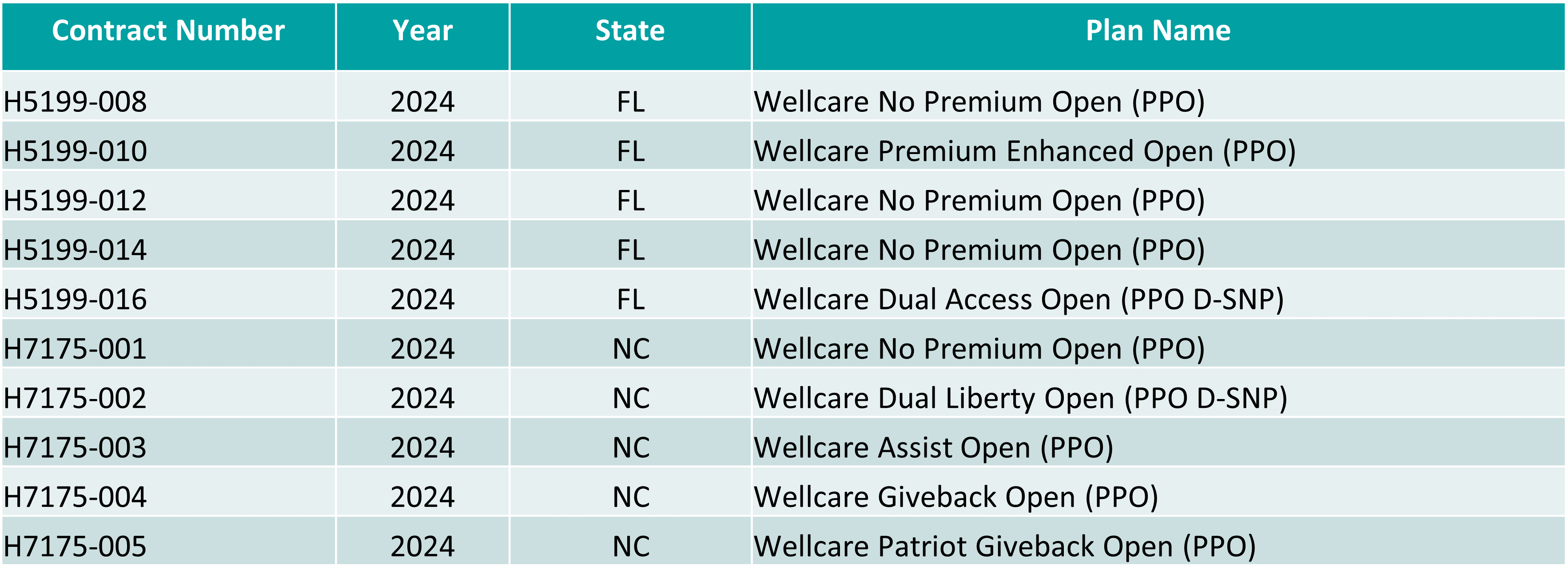

| WellCare | 10 | WA, OR, LA, NY, CA |

- The above plans will be greyed out within the Marketplace starting on 11/4

- Commissions will be paid on renewals for existing members and 2025 sales submitted prior to 11/4

Rest assured, only a limited number of our plans are affected, and we continue to offer a wide range of competitive options to serve all impacted areas smoothly.

Please reach out to your account manager if you need any guidance on navigating these adjustments or have questions about how this may impact your work. Thank you for your resilience and adaptability as we move forward together!